Always investigate further as high or low, there may be a valid reason for the number at hand. Keep in mind, industry standards will vary because companies vary in size and geographical location. Compare the ratio to industry standards. This is not perfect, but does provide some indication how you compare to other companies of the same type.So, paying too frequently may indicate money is not being reinvested and thus missing out on investment opportunities. In a perfect world, you want to reinvest cash back into your business and continue growing. Likewise, a decreasing ratio means you are paying slower and may have cash shortages or delays in accounts receivable collections.

It probably means the company has plenty of cash and is also collecting receivables timely in order to pay their vendors timely. Compare the ratio to previous periods and determine which direction the number is heading. A turnover ratio that is getting bigger means the company is paying its suppliers quicker.Like most things there isn’t one fixed answer but consider the following. So, what is a good number for the accounts payable turnover ratio? Is my number a good number? What is a good number for accounts payable turnover? You can find your accounts payable balance in the liability section of your balance sheet for the respect periods.

#ACCOUNTS PAYABLE TURNOVER PLUS#

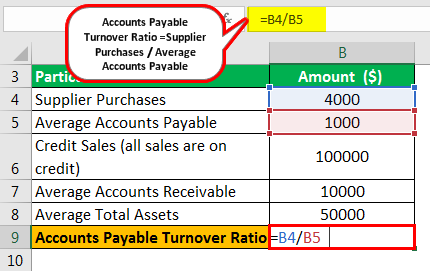

To calculate take the beginning balance of the period plus the ending balance of the period and divide it by 2. AVERAGE ACCOUNTS PAYABLEĪverage accounts payable means the average payable balance during the period. You can calculate net credit purchases by taking the beginning purchases balance, less the ending purchases balance, minus any cash purchases during the period.

Since accounts payable only relates to credit purchases it is important to remove any cash purchases, otherwise the calculation may produce an incorrect ratio. If your calculation is for a year, consider all credit purchases for the year. When the calculation is for a month, only count the credit purchases during the month. Net credit purchases is the total amount you bought on credit during the period.

0 kommentar(er)

0 kommentar(er)